Precise and efficient

equipment inventory services.

Maintaining an organized equipment management program and adhering to regulations requires efficient tracking of equipment assets. Conducting periodic inventories is essential to identify and rectify any inconsistencies in database records, as well as promote the adoption of consistent equipment naming conventions. However, conducting this inventory can be challenging due to limited time and resources. Fortunately, Budget Guard offers streamlined services to simplify this task. Whether you require turnkey services with "boots on the ground" or just project management and database cleansing, Budget Guard has the systems and expertise to complete the job with precision and efficiency.

Let us contact you!

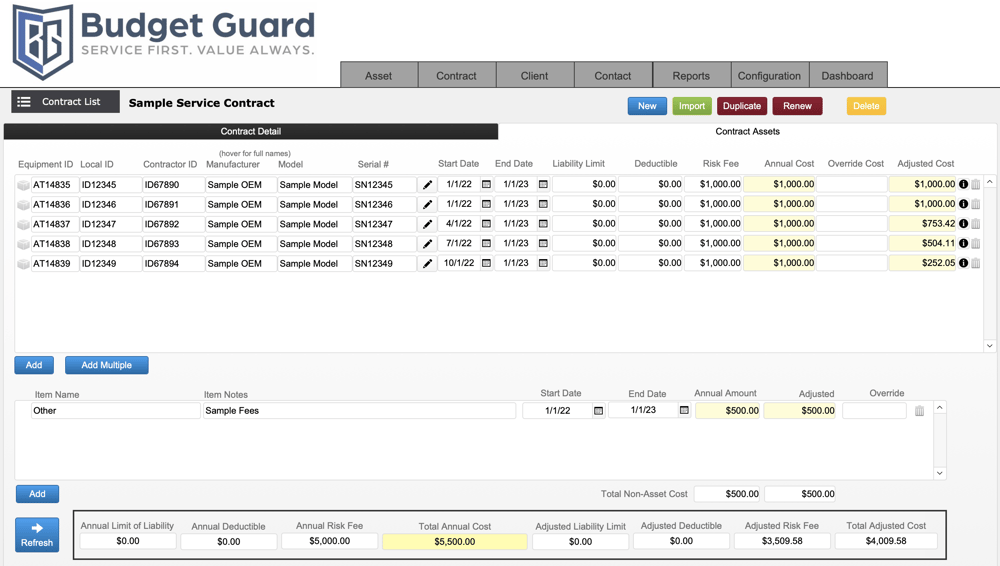

Budget Guard’s innovative

SystemsRx platform offers:

- Physical inventory and database clean-up services

- A complete and accurate inventory of your equipment

- Best practices for maintaining an accurate inventory

Lets begin the conversation!

The Budget Guard Difference

The inventory team performs a wall-to-wall physical inventory, utilizing data capture tools and project management frameworks, to complete this portion of the project.

SystemsRx, our proprietary equipment management software, collects and captures all equipment details through mobile technology, verifying asset identifiers and nameplates to ensure comprehensive data.

We then map all assets using industry-specific nomenclature, internal department and

account codes, and lifecycle milestones such as acquisition cost, date, and estimated useful life.

Through our physical inventory, we identify equipment assets that are:

- In your existing database but not found in your facilities

- Found in your facilities but not listed in your current database

- Found and verified but have missing or inaccurate data

Once complete, this clean data reflects your true Equipment Assets Inventory.

Maintaining relevant data saves you time and money, while ensuring regulatory compliance.

One step further: Service Contract Verification

Does your current service contract management system collect equipment asset

details or properly monitor equipment additions or deletions?

If not, your organization may be at risk for regulatory non-compliance, equipment downtime, and unnecessary expenses.

Budget Guard offers a structured contract verification service in addition to any asset inventory and data cleaning project. This ensures that the equipment covered by a service contract is still active.

We collect your equipment service contracts, then identify assets listed in these contracts that were not found in your facilities during physical inventory.

You can use this information to update your active service contracts, seek credits from

contractors when applicable, and develop a customized Equipment Maintenance Insurance program.

Once your equipment inventory is complete, it's time to cover your assets.

Learn more about Budget Guard Equipment Maintenance Insurance:

Partner with us today and unlock the full potential of your equipment management strategy.